Ah, those tricky millennials. We think we know exactly who they are, but do we, really? There are a lot of myths out there about this generation, making them a difficult target for financial institutions looking to appeal to a growing market.

So instead of trying to figure out which perceptions of millennials are accurate and which aren’t, it’s best to stick to the facts — yes, we’re talking about hard numbers, data, facts. We’ve compiled five that are especially important as it relates to financial services marketing, along with some actionable items to help you gain traction in your marketing efforts with millennials.

How are you competing with on-demand start-ups developing products, such as microinsurance? If you’re not tracking this, and a few other trends, here’s a quick update.

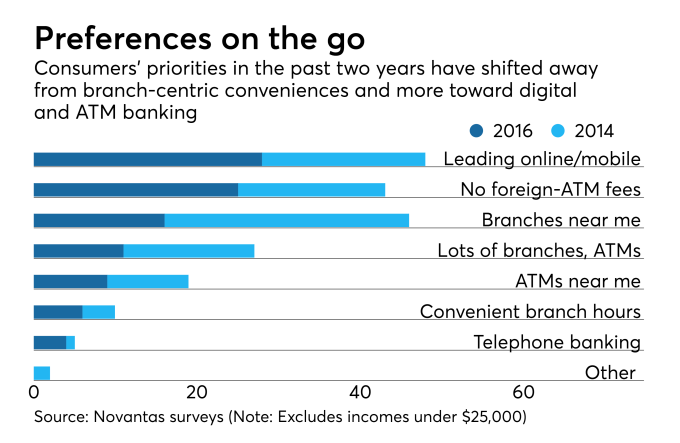

A recent article by American Banker highlights how big banks are investing millions in upgrading their ATM experience.

JPMorgan Chase and Bank of America—which operate more than 15,000 ATM—recently began rolling out sleek machines that look and feel like iPads. But cash withdrawals have stagnated as younger consumers are drawn to online and mobile banking. Clearly, digital is the future.